Trump Presses Ahead with Tariffs. What Now?

31 October 2025

Over the weekend, Trump issued executive orders to impose a 25% tariff on the majority of imports from Canada and Mexico and an additional 10% levy on all imports from China. Mexican energy imports will be subject to the full 25% duty, but duties on Canadian oil imports will be much reduced to 10%. President Donald Trump also reaffirmed his stance warning to increase tariffs on the EU citing the "tremendous deficit" with the EU. Additionally, he declared that he would "eventually" impose taxes on pharmaceuticals, steel, copper, aluminium, and semiconductors.

As expected in response, the Canadian government has announced a 25% duty on some US imports starting from February 4. Canada is also considering putting some restrictions on vital mineral and energy exports to the US. Mexico has also wowed punitive actions with tariff and non-tariff measures in response. China condemned the tariff hikes, claiming they were against international trade regulations. It also said it would contest the levies at the WTO and take "countermeasures," which have not yet been defined.

How Has the Market Reacted, So Far!

Investors did not take Trump's tariff threats seriously until Friday, which is why the initial market reaction to the news has been so negative. Some market participants continue to believe that these tariffs are a negotiating weapon, and they may be lifted if they believe that their trading partners are complying. In that context, Trump's remarks on Friday, relating the tariffs to the US's bilateral trade imbalances and implying that they were "purely economic," are more worrisome. Deficits are more a complicated beast and are not as easily "negotiated" away as other non-trade issues including drug trafficking and immigration.

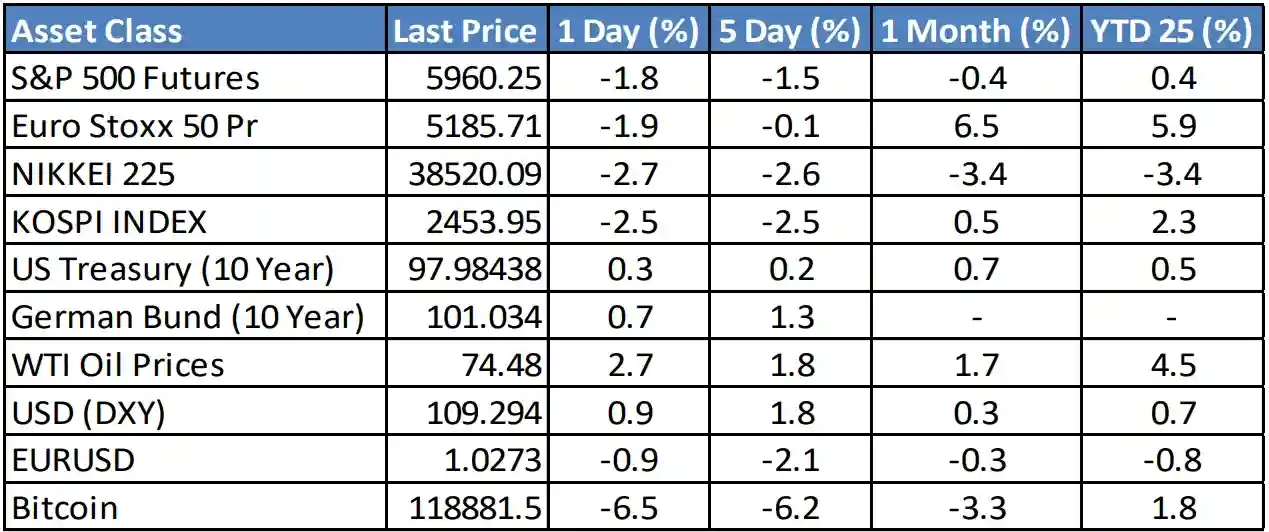

How significant the market reaction will be to the announcement will depend on how sustainable and effective these tariffs are and whether they are quickly rescinded as an agreement is reached or if will this lead to a tit-for-tat measure by the trading partners and lead into an all-out trade war. As of Monday morning, in the markets–

*Source: Bloomberg *

- [object Object] USD and JPY have both straightened. The dollar has traded about 1.5% higher versus the Canadian dollar and the euro. The Mexican peso is expected to gap lower versus the USD on the open. The Chinese renminbi has remained firm for now, but China is on holiday until Wednesday.

- [object Object] Following Friday's losses, US futures have plummeted this morning (S&P 500 futures -1.93%, Nasdaq futures -2.46%, and Dow futures -1.0%). As the market gets ready for a big earnings week that includes Alphabet, Amazon, AMD, and Palantir, as well as Friday's Nonfarm Payrolls report, volatility may continue to be a focus. European markets began the day significantly lower, with the STOXX 50 down 2.4%, but by lunchtime, they had levelled off at 11 a.m. London time, the German DAX was down 1.7%. Asian stocks plummeted with South Korea's KOSPI down 2.5%, and Japan's Nikkei fell 2.7%. Chinese markets closed for the Lunar New Year holiday but are set for tumultuous reopening on Wednesday

- [object Object] US treasury yields have been rangebound so far, possibly caught between the risk of inflation and their attraction as a safe haven, which prevented an early sell-off. On the other hand, European rates plummeted on Friday and opened significantly lower following the unexpected decline in German inflation.

- [object Object] Oil is the only notable asset class that traded higher on Monday morning on concerns that tariffs will lead to higher gasoline and diesel costs at the pumps. Meanwhile, gold attracted fresh safe-haven demand, reaching record highs.

- [object Object] Cryptocurrencies suffered over the weekend. Bitcoin -3.44% ($94,321), Ethereum - 12.72% ($2,517), XRP -10.06%),

Where Should Investors Focus?

The recent round of tariffs and the looming threat towards the EU are likely to keep volatility high in the coming weeks, at least until investors have a better idea of where US trade policy is headed.

More volatile markets require an increased focus on portfolios. Within equities, investors should look at larger companies with strong cash flows and maintain focus in the US. It is still too early to bottom fish, and capital preservation should be the key. At the same time, high-quality bonds including US Treasury and German bunds offer some insulation against uncertainty and can help diversify portfolios.

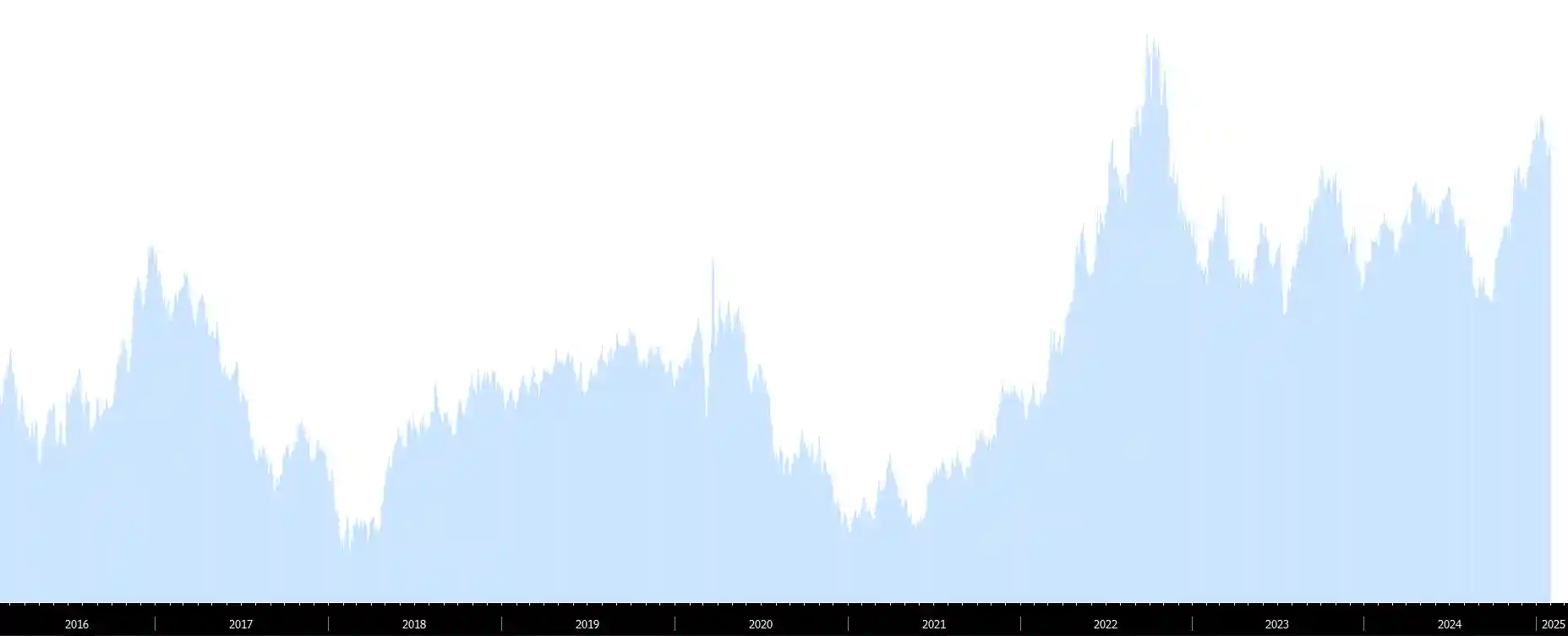

Currency markets are likely to react strongly to changes in trade policy, giving investors the chance to take advantage of volatility spikes to increase portfolio income. While trade uncertainty is still quite high, the euro is likely to remain under pressure over the next few months. Swiss frac’s fortunes are closely tied to the euro, so is likely to remain weak against the USD. Sterling might end up strangely winning all of this, particularly if Starmer were to strike a deal with the US. All things considered, the strength of the US dollar is expected to persist in the near future and possibly throughout 2025.

DXY Index

*Source: Bloomberg *

Gold also remains an effective hedge against geopolitical and inflation risks. Oil could also remain well bid in the near term.

Disclaimer

This document has been produced solely for information purposes by WealthFusion Limited with the greatest of care and to the best of its knowledge and belief for use by its legal entities. The information contained herein constitutes a marketing communication and should not be construed as financial research or analysis, an offer, a public offer, investment advice, a recommendation or solicitation to buy, sell or subscribe to financial instruments and/or to the provision of a financial service. Further, this document is not intended to provide any financial, legal, accounting or tax advice and should not be relied upon in this regard. The information provided herein is for the exclusive use of the recipient and may not be reproduced, disclosed or distributed, neither in part nor in full. This document is not directed at, or intended for distribution to or use by, any person or entity domiciled or resident in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable laws or regulations of such jurisdictions.

Any investment decision must be based on a prior study of the offering documentation and in particular the terms and conditions and key information documents. This information can be obtained on request and will be free of charge from your relationship manager. The content of this document is intended only for persons who understand and are capable of assuming all risks involved. This document has been prepared without taking into account the investor classification, specific investment objectives, financial situation, tax situation or the needs of the recipient. Products and services are not suitable for all investors and may not be available to investors residing in certain jurisdictions or with certain nationalities. Before entering into any transaction, the recipient should consider the suitability of the transaction to individual circumstances and objectives. WealthFusion Limited recommends that investors independently assess, with a professional financial advisor, the specific financial risks as well as the legal, regulatory, credit, tax and accounting consequences. Investment products may be subject to investment risks involving, but not limited to, possible loss of all or part of the principal investment.

This document is not intended to be exhaustive on all risks related to financial instruments. Therefore, the recipient should consult the specific product documentation and discuss any queries with their relationship manager prior to entering into an investment decision. The information and views expressed at the time of writing are subject to change at any time without notice and there is no obligation to update or remove outdated information. Historical data on the performance of the securities and financial instruments or the underlying assets in this document is no indication for future performance and the value of investments may fall as well as rise. This document is based on publicly available information and data. Although information in this document has been obtained from sources believed to be reliable, WealthFusion Limited provides no guarantee with regard to the timeliness, accuracy or completeness of the information and does not accept any liability for any loss and/or damage, either directly or indirectly, arising out of or in connection with the use of all or part of this information or from the omission of certain information. Recipients should be aware that the terms and conditions and key information documents constitute the sole binding basis for the purchase of investment funds. Some investments may foresee restrictions to target group of investors.

Discover Similar Insights

Every day, our experts deliver fresh insights on trending topics,

sectors and markets to help you stay ahead of the curve.

I Inherited a windfall - it was a blessing and a curse

"If you don't do the personal work of really acknowledging your privilege, understanding your responsibility to redistribute away resources and your power - and so sometimes acknowledging the fact that you're not the best person to make those investment or philanthropic decisions - then, of course, the whole thing doesn't work." “Unfortunately for some other of my relatives who received the money, ended up corrupting their lifestyle and also their mental health, so it wasn't good for them, and that money was wasted." Some $90 trillion (£69 trillion) will be transferred to American millennials

Dividend Stocks – potential to Outshine Bonds in a Low Interest Rate Environment

Introduction As we approach September 2024, a significant shift in the financial landscape looms large. The Federal Reserve, having spent much of the past few y…

Market Correction – What is Ahead for Investors!

Introduction Since November 2023 US stocks have rallied almost 30% until the recent drawdown that started in early April. The S&P 500 was down as much as 5.5% i…

Hotel Tycoon Takes £6m Life Insurance to Shield Business from Inheritance Tax Hike

‘I’m insuring my life for £6m to protect family from IHT raid’ More business owners are seeking policies to protect their assets from ‘death tax’ for after they…