Hotel Tycoon Takes £6m Life Insurance to Shield Business from Inheritance Tax Hike

31 October 2025

‘I’m insuring my life for £6m to protect family from IHT raid’

More business owners are seeking policies to protect their assets from ‘death tax’ for after they have gone

A BRITISH hotel tycoon is buying a £6m life insurance policy to protect his fortune from Rachel Reeves’s inheritance tax raid.

Steve Perez, who owns a string of upmarket restaurants and hotels in the East Midlands, as well as the drinks company Global Brands, said he is taking the step to ensure his family will not have to sell parts of his empire if he dies.

It comes after the Chancellor unveiled a string of changes to inheritance tax (IHT) rules during her maiden Budget, including slashing relief for business assets.

Mr Perez said: “I’m 68 and come April next year my business potentially will have a huge, huge tax bill.” He added that in order to keep the business going “not necessarily for [his] heirs’ benefit but for his employees and to protect the business”, he is taking out a life insurance policy costing him about £6m.

“I built this business up from the back of a van and we now employ 400 people in Derbyshire,” he said. “I suspect if the business had to be sold, it would go to a foreign corporation or it would go to a private equity type of business which wouldn’t care about the local area and employees as I do.

“Instead of investing ... into the business, I’m having to take money out ... to pay the life insurance policy, just in case I die while these laws are in place.”

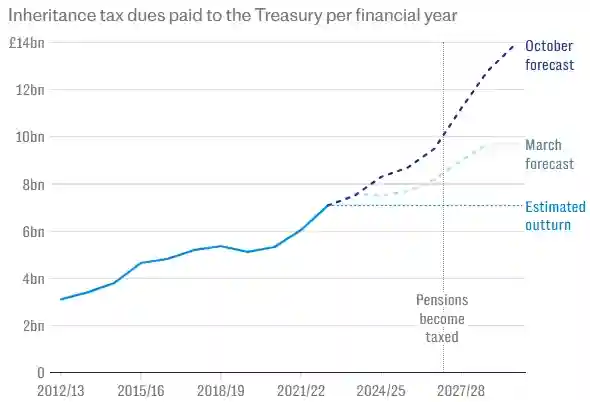

Reeves’s rule changes to double IHT receipts by the end of the decade

Mr Perez founded Global Brands in 1997 after creating the vodka cocktail drink VK. He later expanded into hospitality, building the Casa Hotel and buying the Peak Edge Hotel, both in Chesterfield. In his spare time, he is a competitive rally driver.

He is among many business owners grappling with changes to IHT rules. Previously, properties used for business purposes could be passed down without incurring inheritance tax.

From next April, properties with a value of more than £1m will pay a 20pc rate. Bosses have argued that the changes discourage investment, warning many family-owned businesses will be forced to sell up if they cannot pay the levy.

Farmers in particular have been incensed by the decision to axe tax relief for agricultural properties over £1m.

Insurers have reported a rise in individuals looking to take out life policies since the Budget. Life assurance pays out when the holder dies, while insurance pays out if the holder dies within a specified period.

Mr Perez’s policy will cover him for 10 years: “Should it not be changed in the next 10 years, hopefully, we’ll get a government in, whoever it might be, who’ll see common sense.”

However, given the size of his business empire, he said his initial £6m policy would not be big enough to pay for his inheritance tax bill if he died.

He said: “That’s the first quote I’ve had but I’m probably going to have to increase that to at least £10m. I’ve got no incentive to grow the business now.

“Now the bigger the business grows, the more I’m going to have to pay out in life insurance,” he said.

Discover Similar Insights

Every day, our experts deliver fresh insights on trending topics,

sectors and markets to help you stay ahead of the curve.

I Inherited a windfall - it was a blessing and a curse

"If you don't do the personal work of really acknowledging your privilege, understanding your responsibility to redistribute away resources and your power - and so sometimes acknowledging the fact that you're not the best person to make those investment or philanthropic decisions - then, of course, the whole thing doesn't work." “Unfortunately for some other of my relatives who received the money, ended up corrupting their lifestyle and also their mental health, so it wasn't good for them, and that money was wasted." Some $90 trillion (£69 trillion) will be transferred to American millennials

Dividend Stocks – potential to Outshine Bonds in a Low Interest Rate Environment

Introduction As we approach September 2024, a significant shift in the financial landscape looms large. The Federal Reserve, having spent much of the past few y…

Market Correction – What is Ahead for Investors!

Introduction Since November 2023 US stocks have rallied almost 30% until the recent drawdown that started in early April. The S&P 500 was down as much as 5.5% i…

The Magnificent Seven’s impact on the S&P 500

Market Concentration and the “Magnificent Seven” The S&P 500, a key barometer of the US stock market, is currently exhibiting a remarkable degree of market conc…