Dividend Stocks – potential to Outshine Bonds in a Low Interest Rate Environment

31 October 2025

Introduction

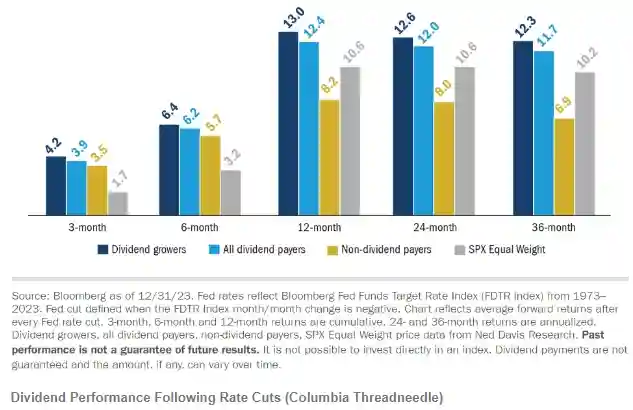

As we approach September 2024, a significant shift in the financial landscape looms large. The Federal Reserve, having spent much of the past few years hiking interest rates to combat inflation, is now expected to pivot toward cutting rates. This change could open new opportunities for investors, particularly in the realm of high-yield dividend stocks. Historically, rate cuts have had a profound impact on various asset classes, and high-yield dividend stocks have often emerged as winners compared to more traditional income vehicles such as bonds and certificates of deposit (CDs).

Companies with a constant and reliable source of income in the form of dividends do well over the long run. These companies are particularly attractive to investors seeking a combination of regular income and capital appreciation. In the environment that lies ahead, these stocks could prove compelling as yields from bonds and CDs drop as a result of the interest rate cuts by the central banks across the developed world. Dividends are likely to be maintained, and there is a potential for these payments to even increase.

Empirical Evidence: The Case for Dividend Stocks

High-yield dividend stocks, known for their above-average payouts (often in the range of 4% to 8%), have long been a cornerstone for income investors. These stocks tend to hail from sectors like consumer staples, real estate, and utilities, as the companies in these sectors are more mature and have more reliable cash flows. When interest rates fall, as expected in September 2024, the relative appeal of these stocks should increase.

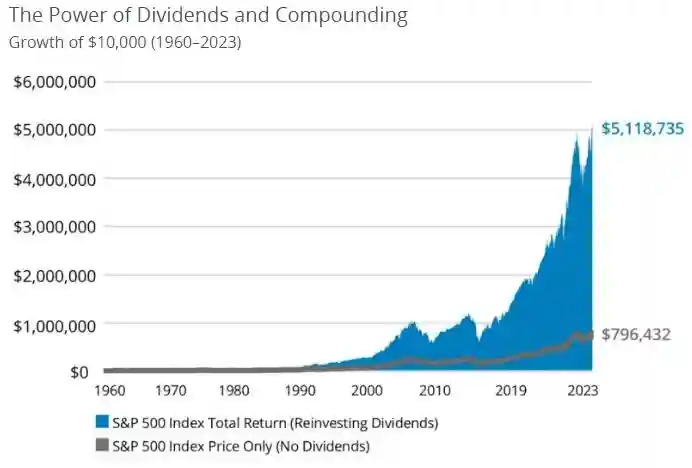

Empirical evidence shows that the companies that distribute regular shares of their income to shareholders tend to register higher value over the long term. These regular income streams are particularly valued by investors when market conditions get tough, as dividends can help absorb some price volatility. Many established companies with a long history of paying dividends also have been shown to provide growth in those dividends. This growth not only protects against inflation but also allows investors to enjoy a rising income stream.

More generally, dividend-paying stocks have historically exhibited lower volatility than the broad equity market, especially in times of economic uncertainty. By construct, these high dividend-paying stocks often operate in mature, defensive industries that are less exposed to economic cycles and have more stable cash flow profiles. Also, by committing to stable and growing dividends, management signals confidence in their future, enhancing stock price prospects. Moreover, a progressive dividend policy acts as a disciplinary factor, as any surplus cash must be prioritized to return to shareholders before it can be used for non-core or risky endeavours by management.

For example, the S&P 500 Dividend Aristocrats Index. —companies that have consistently increased their payouts for at least 25 consecutive years. These stocks have historically outperformed fixed-income investments during periods of falling interest rates. In a lower-rate environment.

Why now?

As the Federal Reserve embark on its rate cutting cycle, the yields on bonds and CDs are set to fall. For instance, following a 50- basis point rate cut, a one-year CD that currently yields 4.5% could drop to around 4% or even lower. Similarly, yields on Treasury bonds are expected to fall. In such an environment, high-yield dividend stocks can offer yields that surpass those of CDs and bonds. For example, a stock with a 5% yield remains attractive when bond yields drop below 4%. Even in a lower-rate environment, these stocks can continue to deliver competitive income, making them a more appealing choice for investors seeking yield.

The dividends also have a unique advantage: they can grow over time. Businesses can raise their prices in response to higher inflation, leading to increased revenue and, that in turn, can lead to dividend growth. In contrast, bonds generally offer fixed payments, which do not adjust for inflation. As a result, dividends can help protect the purchasing power of investors in an inflationary environment.

Moreover, high-yield dividend stocks offer the potential for capital appreciation. When interest rates decline, stock prices generally rise. This is particularly true for sectors like utilities and real estate, where companies benefit from lower borrowing costs. As companies become more profitable, their stock prices often increase, providing investors with the opportunity to earn not only from dividends but also from capital gains. This is a key differentiator from fixed-income products like bonds, where typically capital appreciation is limited in most cases.

Certain sectors tend to thrive in a declining rate environment. For example, real estate benefits from lower borrowing costs, boosting demand for properties. Similarly, the financial sector sees increased financing opportunities for both businesses and individuals. Consumer discretionary stocks also gain from reduced borrowing costs, leading to higher spending on big-ticket items like homes and cars. As demand for loans grows, bank stocks become even more appealing in such an environment, making these sectors attractive for dividend-seeking investors.

Final Thoughts: The 2024 Outlook for High-Yield Dividend Stocks

As we move toward a lower interest rate environment in September 2024, high-yield dividend stocks stand out as an attractive investment option. With the potential to offer higher yields, growing dividends, and capital appreciation, they provide a compelling alternative to bonds and CDs. Companies that have a consistent and reliable source of income, in the form of dividends, tend to do well over the long term. These stocks are particularly attractive to investors who are looking for a combination of regular income and capital appreciation.

We believe, when seeing such investments, investors should focus on companies with above average dividend growth potential with solid balance sheets. The focus should also be on the quality of the running income via earnings growth that will underwrite current dividend payments and future payments. Overall, the emphasis should be on defensive qualities, which should provide additional financial headroom in a downturn. High-yield dividend stocks offer investors flexibility from a reinvestment perspective. Dividends can be reinvested into additional shares, allowing for the compounding of returns over time without the need for additional capital. This strategy can help investors accumulate more shares and increase their income over time, making high-yield dividend stocks a compelling choice in a lower-rate environment.

While bonds and CDs remain safe and stable options, their fixed returns may struggle to keep pace with inflation and potential dividend growth, especially in a falling-rate environment. Hence, for investors seeking both steady returns and the opportunity for growth, they ought to look for a selection of high dividend paying stocks could offer superior total returns over the medium term.

Disclaimer

This document has been produced solely for information purposes by WealthFusion Limited with the greatest of care and to the best of its knowledge and belief for use by its legal entities.

The information contained herein constitutes a marketing communication and should not be construed as financial research or analysis, an offer, a public offer, investment advice, a recommendation or solicitation to buy, sell or subscribe to financial instruments and/or to the provision of a financial service. Further, this document is not intended to provide any financial, legal, accounting or tax advice and should not be relied upon in this regard.

The information provided herein is for the exclusive use of the recipient and may not be reproduced, disclosed or distributed, neither in part nor in full. This document is not directed at, or intended for distribution to or use by, any person or entity domiciled or resident in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable laws or regulations of such jurisdictions.

Any investment decision must be based on a prior study of the offering documentation and in particular the terms and conditions and key information documents. This information can be obtained on request and will be free of charge from your relationship manager.

The content of this document is intended only for persons who understand and are capable of assuming all risks involved. This document has been prepared without taking into account the investor classification, specific investment objectives, financial situation, tax situation or the needs of the recipient. Products and services are not suitable for all investors and may not be available to investors residing in certain jurisdictions or with certain nationalities. Before entering into any transaction, the recipient should consider the suitability of the transaction to individual circumstances and objectives. WealthFusion Limited recommends that investors independently assess, with a professional financial advisor, the specific financial risks as well as the legal, regulatory, credit, tax and accounting consequences. Investment products may be subject to investment risks involving, but not limited to, possible loss of all or part of the principal investment. This document is not intended to be exhaustive on all risks related to financial instruments. Therefore, the recipient should consult the specific product documentation and discuss any queries with their relationship manager prior to entering into an investment decision.

The information and views expressed at the time of writing are subject to change at any time without notice and there is no obligation to update or remove outdated information. Historical data on the performance of the securities and financial instruments or the underlying assets in this document is no indication for future performance and the value of investments may fall as well as rise. This document is based on publicly available information and data. Although information in this document has been obtained from sources believed to be reliable, WealthFusion Limited provides no guarantee with regard to the timeliness, accuracy or completeness of the information and does not accept any liability for any loss and/or damage, either directly or indirectly, arising out of or in connection with the use of all or part of this information or from the omission of certain information.

Recipients should be aware that the terms and conditions and key information documents constitute the sole binding basis for the purchase of investment funds. Some investments may foresee restrictions to target group of investors.

Discover Similar Insights

Every day, our experts deliver fresh insights on trending topics,

sectors and markets to help you stay ahead of the curve.

I Inherited a windfall - it was a blessing and a curse

"If you don't do the personal work of really acknowledging your privilege, understanding your responsibility to redistribute away resources and your power - and so sometimes acknowledging the fact that you're not the best person to make those investment or philanthropic decisions - then, of course, the whole thing doesn't work." “Unfortunately for some other of my relatives who received the money, ended up corrupting their lifestyle and also their mental health, so it wasn't good for them, and that money was wasted." Some $90 trillion (£69 trillion) will be transferred to American millennials

Market Correction – What is Ahead for Investors!

Introduction Since November 2023 US stocks have rallied almost 30% until the recent drawdown that started in early April. The S&P 500 was down as much as 5.5% i…

Hotel Tycoon Takes £6m Life Insurance to Shield Business from Inheritance Tax Hike

‘I’m insuring my life for £6m to protect family from IHT raid’ More business owners are seeking policies to protect their assets from ‘death tax’ for after they…

The Magnificent Seven’s impact on the S&P 500

Market Concentration and the “Magnificent Seven” The S&P 500, a key barometer of the US stock market, is currently exhibiting a remarkable degree of market conc…