The tragic inheritance tax quirk that could save you £400k

31 October 2025

“Couples who die at the same time can pass on all of the

older person’s assets free of inheritance tax.”

The little-known rule can save relatives hundreds of thousands of pounds if their loved ones’ deaths were simultaneous or when it is unknown who died first.

But the law only works this way in England and Wales, and not in Scotland and Northern Ireland.

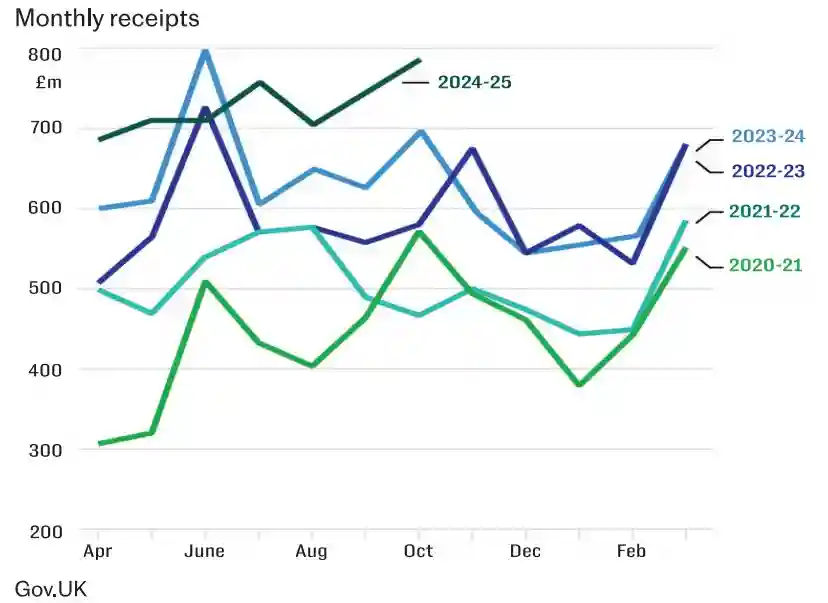

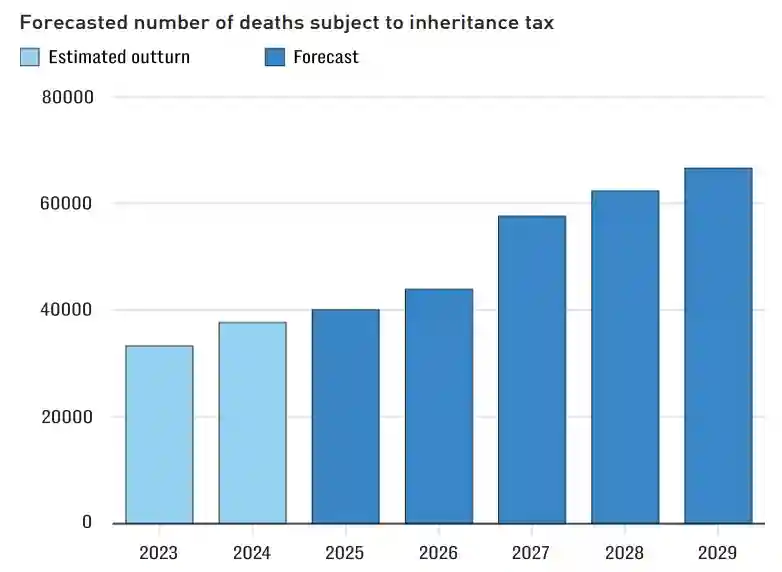

It comes as estates in the UK have already paid a record. £7bn in inheritance tax this financial year, up £700m on the same period last year, and it’s expected to rocket after Labour makes pensions liable for the charge in 2027.

Inheritance tax haul hits record levels

Known informally as the death duty, inheritance tax is charged at 40pc. Individual estates come with a “nil-rate band” of £325,000, which escapes the charge, and another £175,000 – the residence nil-rate band – can be claimed on a main property left to direct descendants.

Married couples or civil partners can combine allowances to £1m, even if one has already died, and there’s no inheritance tax on anything they leave to each other.

However, if a married or civil partnered couple both die, they have wills and it’s unknown who passed away first – such as if they are involved in an accident where they live plays a huge role in the inheritance tax due.

In England and Wales, when the order of death is unknown, it’s legally presumed that the eldest passed away first. Where inheritance tax is a consideration, they are judged to have died simultaneously.

This means if a married couple died together with £2m of assets including a home, it would first pass from the elder to the younger without any inheritance tax.

When it was then passed on again, as the deaths are considered simultaneous, the elder person’s share is excluded and only the younger person’s half would be considered for inheritance tax. If it was left to the couple’s children, the available allowances mean the charge would be £0 in this case.

The same would apply to any assets the older person held solely, such as Isas, shares or property – which can be substantial. They pass to their deceased spouse and then instantly to their children, but are not considered for inheritance tax.

This is even more beneficial than if they had died a day apart, because in that situation the first person’s assets would also have been assessed and taxed.

Estates in the UK have already paid a record. £7bn in inheritance tax this financial year, up £700m on the same period last year

If a married couple died together with £2m of assets including a home, it would first pass from the elder to the younger without any inheritance tax.

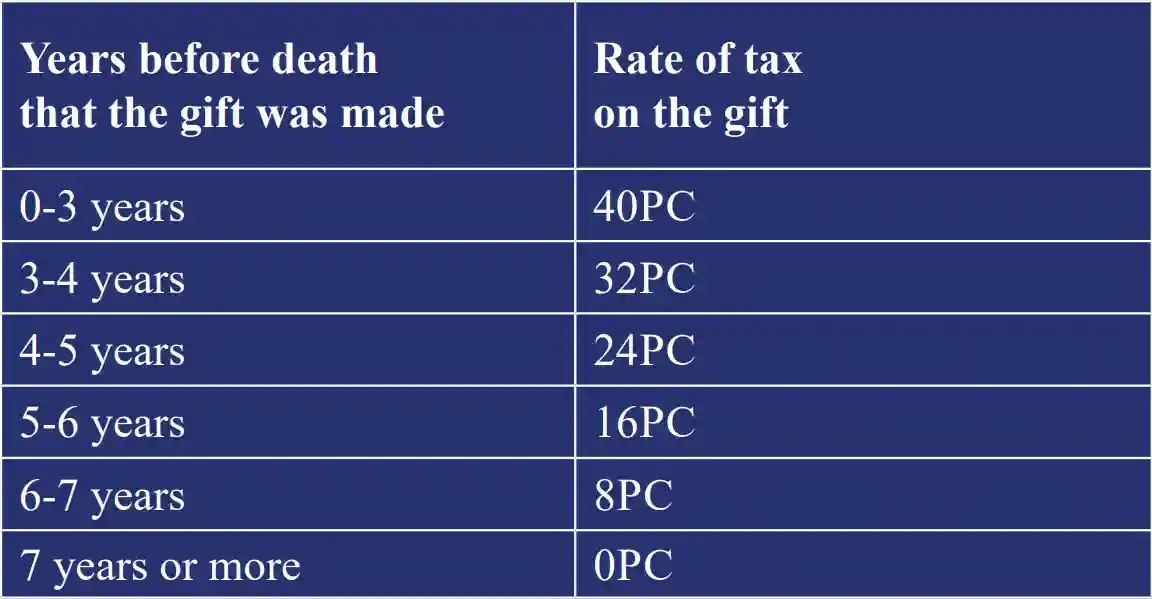

Rate of inheritance tax paid on gifts, in the event of the donor’s death

In Scotland and Northern Ireland, however, both people are presumed to have died simultaneously, so their assets don’t pass to the other. Inheritance tax would be charged for each person, leaving their beneficiaries with a total bill of £400,000 in this scenario. The same applies to any individual assets.

If the couples were not married or civil partners, there could be more inheritance tax to pay in each country as there would be no £175,000 residence nil rate bands.

Clare Moffat, of Royal London, said: “If something like this happens, it’s so hard on families having to deal with not only one but two deaths. The fact that you’re going to have a bigger inheritance tax bill depending on where you live can make an already difficult time even harder.

“For a couple whose wealth is passed on to their children, more tax would be paid in Scotland andNorthern Ireland. I don’t think there’s anything youcan do that’s going to change the situation, but it just shows how important planning is.

“It’s vital to think about and talk through the things you actually can control.”

Simultaneous deaths are rare, as is research on the topic. In 1994, the US-based Committee on Individual Life Insurance Experience Studies examined policies from 29 providers and found that in every 1,000 deaths, 40 occurred from a common cause or within 30 days of each other. The sample included four aviation accidents and three car crashes.

Studies have also shown that people have a significantly higher risk of dying within the first 90 days of losing their spouse, known as the “widowhood effect”.

However, where the order of death is clear and there is a gap, or the eldest has a survivorship clause dictating that the beneficiary must outlive them by a certain number of days, the exemption for England and Wales would not apply.

Deaths triggerings inheritance tax to double

James Ward, of law firm Kingsley Napley, said: “This provision exists so that if, for example, a father and son die together and the father left his estate to his son, they are not subject to inheritance tax on the estate twice.

“However, this is not applicable if the elder person dies without a will or there is a survivorship clause in their will, which would state that the beneficiary must live for a set amount of days to inherit the estate.

“All the survivorship clauses we write have an exception for simultaneous deaths to provide for this scenario.”

Alison Penny, of the Childhood Bereavement Network, said around 27,000 parents with children under 18 die each year.

She added: “Sadly, in some rare cases, both parents die at the same time, leaving the children facing huge upheaval alongside their grief and devastation.

“We encourage all parents to plan ahead to put things in place that would make things more comforting and comfortable for their children if one or both were to die before the children grow up. That could be appointing guardians, writing letters to their child’s future self, and planning their finances for all eventualities.”

We encourage all parents to plan ahead to put things inplace that would make things more comforting and comfortable for their children if one or both were to die before the children grow up.

Discover Similar Insights

Every day, our experts deliver fresh insights on trending topics,

sectors and markets to help you stay ahead of the curve.

I Inherited a windfall - it was a blessing and a curse

"If you don't do the personal work of really acknowledging your privilege, understanding your responsibility to redistribute away resources and your power - and so sometimes acknowledging the fact that you're not the best person to make those investment or philanthropic decisions - then, of course, the whole thing doesn't work." “Unfortunately for some other of my relatives who received the money, ended up corrupting their lifestyle and also their mental health, so it wasn't good for them, and that money was wasted." Some $90 trillion (£69 trillion) will be transferred to American millennials

Dividend Stocks – potential to Outshine Bonds in a Low Interest Rate Environment

Introduction As we approach September 2024, a significant shift in the financial landscape looms large. The Federal Reserve, having spent much of the past few y…

Market Correction – What is Ahead for Investors!

Introduction Since November 2023 US stocks have rallied almost 30% until the recent drawdown that started in early April. The S&P 500 was down as much as 5.5% i…

Hotel Tycoon Takes £6m Life Insurance to Shield Business from Inheritance Tax Hike

‘I’m insuring my life for £6m to protect family from IHT raid’ More business owners are seeking policies to protect their assets from ‘death tax’ for after they…