The Labour Government's First Budget Since 2010

31 October 2025

Key Highlights and Implications for Investors

Introduction

The Autumn budget is aimed to enhance UK growth while modestly raising inflation. In this short note, we look at the announced measures and the potential impact it may have on UK assets.

On October 30, the new Labour government delivered its first Budget after it came into power in July with a sizable majority and pledged to boost the economy. Many of Labour's campaign promises to invest in infrastructure and public services as well as to establish clear guidelines for taxation and spending were carried out in Chancellor Reeves’ Autumn Budget.

Key talking points

- [object Object] The Chancellor opted to increase the employer’s national insurance contributions from 13.8% to 15% from April 2025. This has been combined with a lowering of the secondary threshold for employer’s national insurance from £9,100 to £5,000. However, the employment allowance has been increased from £5,000 to £10,500. The tax receipt from these changes is expected to be around £20bn - a large chunk of the £40bn the Chancellor is targeting from tax increases.

- [object Object] with immediate effect, the CGT will rise from 10% to 18% for the lower rate and from 20% to 24% for the higher rate, aligning it with the rates that apply to residential property disposals. In addition, rates for Investor's Relief and Business Asset Disposal Relief will rise from 10% to 14% for disposals completed on or after April 6, 2025, and from 14% to 18% for disposals completed on or after April 6, 2026. Reeves also declared that the CGT on carried interest would rise to 32% starting in April 2025.

- [object Object] A large-scale tax cut is enacted, fuelling consumer spending, economic growth, and corporate earnings. This benefits smallcap and domestically focused large-cap stocks. However, the increased fiscal deficit pushes bond yields higher. Despite ongoing trade tensions, international stocks remain relatively resilient but are constrained by a stronger dollar and slowing global growth.

- [object Object] there will be no further freeze on personal tax thresholds with these being updated in line with inflation from 2028 to 2029.

- [object Object] the Chancellor affirmed that the existing regulations governing the taxation of non-UK-domiciled individuals would be repealed starting in April 2025. A new residencebased program "with internationally competitive arrangements for those coming to the UK on a temporary basis" will take its place. A Temporary Repatriation Facility (TRF) will be implemented to incentivize people to send their Foreign Income and Gains (FIG) that originated in earlier periods and were not subject to UK taxation in prior years back to the UK. Beginning in April 2025, Reeves extended the TRF from the 2-year period to 3 tax years. For the first two tax years, 2025–2026 and 2026–2027, the allocated sums will be subject to 12% tax, with the rate increasing to 15% for the third year, 2027–2028.

- [object Object] the current freeze on IHT thresholds will be extended by a further 2 years up to 2030.

Perhaps the biggest surprise was a decision to bring inherited pensions (i.e. unused pension funds and death benefits) into the 40% IHT death estate from April 2027. Furthermore, starting in April 2026, the Business and Agricultural property relief programs will undergo modification. For the first £1 million of combined business and agricultural assets, the rate of relief will remain at 100%; beyond that, it will drop to 50%. Families passing on their companies to the next generation will be greatly impacted by this.

Additionally, starting in April 2026, shares that are classified as "not listed" on the markets of a recognized stock exchange, such as AIM, will have their rate of business property relief reduced to 50% in all situations.

- [object Object] starting from October 31, 2024, the Stamp Duty Land Tax on Additional Dwellings will rise from 3% to 5% for secondhome acquisitions, buy-to-let residential properties, and businesses residential properties.

Impact on UK growth & Inflation

The majority of the Budget's pronouncements, including several tax-raising initiatives and modifications to the nation's fiscal regulations, were widely anticipated. Value-added tax (VAT) and income tax rates were left untouched. Rather, Chancellor Reeves increased businesses' contributions to workers' National Insurance payments, which support pensions and other state benefits, from 13.8% to 15%. Capital gains tax were also raised from 10% to 18% for the lower rate payers and from 20% to 24% for the higher rate payers. The Budget upheld most of Labour’s campaign promises including not to increase employees' National Insurance premiums.

The Budget comes against the background where the nominal Gross Domestic Product (GDP) increased due to somewhat stronger-than-expected growth and rather high inflation, which made this year's budget easier for the government to spend. Crucially, in order to increase public investment at a time when debt is already high, the Chancellor also modified the government's selfimposed "fiscal rules," which is closely monitored by the independent Office for Budget Responsibility (OBR).

Existing fiscal rules specify that government debt should be on schedule to reduce as a share of national revenue in five years. Under the Chancellor's new "investment rule," the concept of debt declining as a proportion of GDP is maintained, but the timeline is adjusted to this term in parliament, which is normally five years, and the debt metric is modified to take into account illiquid financial assets like loans and stock holdings. By the end of this decade, the government estimates that it will have an additional £50 billion for infrastructure. The Chancellor also announced that separate governmental bodies will be formed to monitor the expenditures. A new "stability rule" that mandates daily government expenditures and the interest on the national debt be balanced by tax increases.

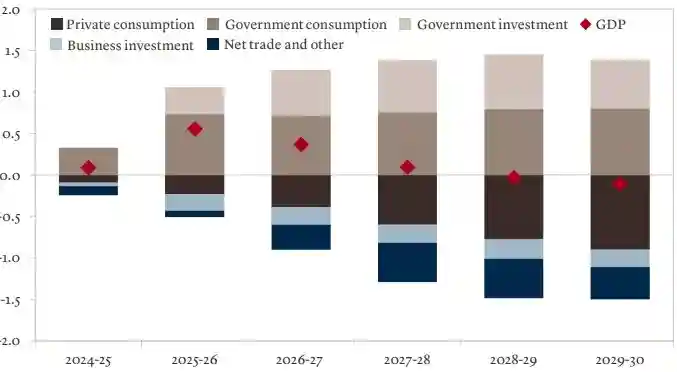

With a focus on public spending, the new budget measures should boost overall growth in the near term -- as projected by the OBR estimates in the Chart below. The measures are likely to boost industries, such as infrastructure, transportation, and renewable energy, as well as the NHS. The budget is also aimed at addressing a longer-term issue the UK economy is facing -- the high rates of long-term illness and absence from work, which have increased significantly since the pandemic. Overall, the measures announced by the Chancellor last week will have limited inflationary impact as companies are likely to absorb a part of the associated costs elsewhere.

*Near-term boost to growth thanks to increases in government spending – OBR estimates *

Data as of 31 Oct 2024 in % points, Source: Office for Budget Responsibility (OBR)

Budget against a better economic backdrop

In 2024, the UK's inflation and growth patterns have already surprised to the upside. With the potential boost from the Budget, growth next year could surpass 1.5%. Indeed, the UK economy saw one of the biggest growth upgrades of any country in the IMF’s World Economic Outlook that was published before the budget - 22 October.

Dynamics of lower-than-expected inflation has allowed the Bank of England (BoE) greater leeway to loosen policy, while better nominal growth has given the Labour government more fiscal headroom. As headline inflation drops below the BoE's objective, we anticipate a further reduction of 25 basis points at the two remaining BoE meetings this year, in November and December. Governor Bailey has acknowledged that inflation has fallen faster than the central bank had expected lately. The balanced approach of the Reeves’ budget should provide the BoE ample room to ease until it reaches a terminal rate, of around 2.5%. However, the path to that will depend on how the BoE evaluates inflation risks from the Budget.

Potential implications for UK assets

From investors’ perspective, UK gilts and equities are likely to be impacted by the budget. The outlook for the latter depends in the overall boost to growth from the budget and global macro backdrop, which has improved since the summer. Outlook for UK gilts is more nuanced we think. While we expect gilt issuance to show a small rise given the new spending announced in the Budget- bad for prices; however, we think the market can easily absorb the extra supply as institutional buyers seek good quality safe haven assets. Gilt’s relative valuations are more favourable versus other safe-haven bonds including German bunds and US Treasuries. The potential for a more aggressive BoE rate-cutting cycle than the Federal Reserve, along with resilient UK growth prospects favour gilts. Ongoing disinflation and normalising labour markets are added boost to gilt.

However, the outlook for sterling is less promising. Due to the Budget uncertainties and dollar haven demand before the US elections, the currency had depreciated against the US dollar in the weeks preceding the budget. However, with better-than-expected GDP, rapidly declining inflation, and a new government, it had been among the top-performing major currencies early in the year, boosting investor morale. Still, weak current account, foreign direct, and portfolio investment patterns indicate that speculative inflows were primarily responsible for this currency support. If the BoE drops rates more aggressively sterling will find it hard to rally meaningfully from its current level of about 1.30 despite the growth boost from the Budget.

Discover Similar Insights

Every day, our experts deliver fresh insights on trending topics,

sectors and markets to help you stay ahead of the curve.

I Inherited a windfall - it was a blessing and a curse

"If you don't do the personal work of really acknowledging your privilege, understanding your responsibility to redistribute away resources and your power - and so sometimes acknowledging the fact that you're not the best person to make those investment or philanthropic decisions - then, of course, the whole thing doesn't work." “Unfortunately for some other of my relatives who received the money, ended up corrupting their lifestyle and also their mental health, so it wasn't good for them, and that money was wasted." Some $90 trillion (£69 trillion) will be transferred to American millennials

Dividend Stocks – potential to Outshine Bonds in a Low Interest Rate Environment

Introduction As we approach September 2024, a significant shift in the financial landscape looms large. The Federal Reserve, having spent much of the past few y…

Market Correction – What is Ahead for Investors!

Introduction Since November 2023 US stocks have rallied almost 30% until the recent drawdown that started in early April. The S&P 500 was down as much as 5.5% i…

Hotel Tycoon Takes £6m Life Insurance to Shield Business from Inheritance Tax Hike

‘I’m insuring my life for £6m to protect family from IHT raid’ More business owners are seeking policies to protect their assets from ‘death tax’ for after they…