Market At Crossroads Scenarios That Could Shape the Next Big Move

31 October 2025

Following the recent market downturn, investors are questioning when stability might return, whether a recession is imminent, and if a shift towards pro-growth policies could occur. While the future remains unpredictable, assessing both downside and upside market scenarios can help frame investment decisions.

Broadly, there are four key market trajectories—equities moving higher or lower, combined with rising or falling bond yields. Below are potential scenarios, that helping investors evaluate how their portfolios may be impacted:

- An escalating trade war dampens business and consumer sentiment, leading to weaker growth and shrinking profit margins due to rising costs. Some of these costs are likely to be passed on to consumers, fuelling inflation. Consequently, equities could decline, while bond yields rise at the same time as inflation edges higher. Safe haven buying and higher rates should push the US dollar higher.

- The US successfully negotiates trade agreements with key partners, removing uncertainty. This boosts growth and encourages stock buybacks, M&A activity, and capital investment. Stocks should rally even as the US dollar weakens. The reduction in tariff-driven inflationary pressures should allow the Federal Reserve to resume its cutting cycle. Bond yields will decline in such a scenario.

- A large-scale tax cut is enacted, fuelling consumer spending, economic growth, and corporate earnings. This benefits smallcap and domestically focused large-cap stocks. However, the increased fiscal deficit pushes bond yields higher. Despite ongoing trade tensions, international stocks remain relatively resilient but are constrained by a stronger dollar and slowing global growth.

- The dominance of US technology firms in AI faces challenges from emerging competitors and technological shifts. The risk is that heavy capital expenditures fail to translate into expected returns, leading to profit disappointments and a market correction. While tech stocks struggle, international and value stocks prove more resilient. Investors seek safety, driving bond yields lower.

Since the start of the year, elements of each of these scenarios have surfaced, contributing to market volatility and unexpected trends. Previously overlooked asset classes—such as longduration bonds, value stocks, and stocks outside of the US —have demonstrated resilience and outperformance.

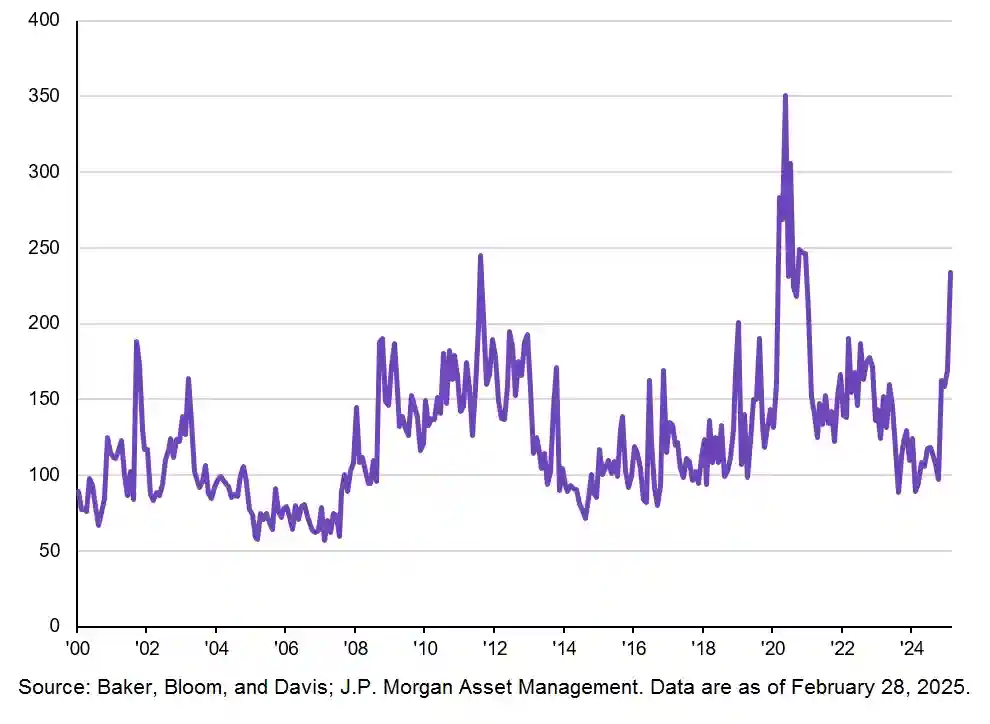

Policy uncertainty has reached its highest levels since the pandemic

US Economic Policy Uncertainty Index

Given the sell-off in stocks and the decline in US real rates, it seems that investors have interpreted tariff news as growth-negative, which will keep equity market volatility high in the near future. The effect on economic growth will mostly depend on the type of medium-term tax cut plan that is approved and how long and high tariffs are maintained.

Our major takeaway is still to continue investing in stocks, albeit sparingly. Trade policy changes and tariff uncertainty underscore the significance of risk management and portfolio diversification. Techniques for capital preservation can help reduce stock market volatility. We continue to favour high-quality fixed income, such as investment-grade corporate bonds, because they can serve as a buffer against trade concerns. A well-diversified multi-asset portfolio should include alternative investments, such as gold if cash rates continue to decline due to looser monetary policy.

Disclaimer

This document has been produced solely for information purposes by WealthFusion Limited with the greatest of care and to the best of its knowledge and belief for use by its legal entities. The information contained herein constitutes a marketing communication and should not be construed as financial research or analysis, an offer, a public offer, investment advice, a recommendation or solicitation to buy, sell or subscribe to financial instruments and/or to the provision of a financial service. Further, this document is not intended to provide any financial, legal, accounting or tax advice and should not be relied upon in this regard. The information provided herein is for the exclusive use of the recipient and may not be reproduced, disclosed or distributed, neither in part nor in full. This document is not directed at, or intended for distribution to or use by, any person or entity domiciled or resident in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable laws or regulations of such jurisdictions. Any investment decision must be based on a prior study of the offering documentation and in particular the terms and conditions and key information documents. This information can be obtained on request and will be free of charge from your relationship manager. The content of this document is intended only for persons who understand and are capable of assuming all risks involved. This document has been prepared without taking into account the investor classification, specific investment objectives, financial situation, tax situation or the needs of the recipient. Products and services are not suitable for all investors and may not be available to investors residing in certain jurisdictions or with certain nationalities. Before entering into any transaction, the recipient should consider the suitability of the transaction to individual circumstances and objectives. WealthFusion Limited recommends that investors independently assess, with a professional financial advisor, the specific financial risks as well as the legal, regulatory, credit, tax and accounting consequences. Investment products may be subject to investment risks involving, but not limited to, possible loss of all or part of the principal investment. This document is not intended to be exhaustive on all risks related to financial instruments. Therefore, the recipient should consult the specific product documentation and diccuss any queries with their relationship manager prior to entering into an investment decision. The information and views expressed at the time of writing are subject to change at any time without notice and there is no obligation to update or remove outdated information. Historical data on the performance of the securities and financial instruments or the underlying assets in this document is no indication for future performance and the value of investments may fall as well as rise. This document is based on publicly available information and data. Although information in this document has been obtained from sources believed to be reliable, WealthFusion Limited provides no guarantee with regard to the timeliness, accuracy or completeness of the information and does not accept any liability for any loss and/or damage, either directly or indirectly, arising out of or in connection with the use of all or part of this information or from the omission of certain information. Recipients should be aware that the terms and conditions and key information documents constitute the sole binding basis for the purchase of investment funds. Some investments may foresee restrictions to target group of investors.

Discover Similar Insights

Every day, our experts deliver fresh insights on trending topics,

sectors and markets to help you stay ahead of the curve.

I Inherited a windfall - it was a blessing and a curse

"If you don't do the personal work of really acknowledging your privilege, understanding your responsibility to redistribute away resources and your power - and so sometimes acknowledging the fact that you're not the best person to make those investment or philanthropic decisions - then, of course, the whole thing doesn't work." “Unfortunately for some other of my relatives who received the money, ended up corrupting their lifestyle and also their mental health, so it wasn't good for them, and that money was wasted." Some $90 trillion (£69 trillion) will be transferred to American millennials

Dividend Stocks – potential to Outshine Bonds in a Low Interest Rate Environment

Introduction As we approach September 2024, a significant shift in the financial landscape looms large. The Federal Reserve, having spent much of the past few y…

Market Correction – What is Ahead for Investors!

Introduction Since November 2023 US stocks have rallied almost 30% until the recent drawdown that started in early April. The S&P 500 was down as much as 5.5% i…

Hotel Tycoon Takes £6m Life Insurance to Shield Business from Inheritance Tax Hike

‘I’m insuring my life for £6m to protect family from IHT raid’ More business owners are seeking policies to protect their assets from ‘death tax’ for after they…